I have been meaning for some time to write a blog on the subject of CBDCs, and am spurred to put finger to keyboard by an excellent article by Barry Eichengreen in today’s FT (5th December) – ‘CBDCs- a bad idea that won’t go away’.

I won’t repeat his arguments. But it is worth thinking for a moment about how a CBDC – say a digital £ – would actually work. It’s digital, so you will need open a digital account (with the Bank of England?) so you can buy your digital £s, and perhaps add them to your Apple or Google Wallet.

My basic problem with CBDCs is this: if you already have a bank current account, what is the difference between your digital £s and the £s in your current account?? For us happy souls who, in the UK at least, still enjoy free in credit banking, the answer is none.

Eichengreen’s article also deals with the financial inclusion argument. It is a little different in the UK, as major banks are required to offer a no-frills no fee no overdraft ‘basic bank account’ which does require credit checking. There are now over 7m of these in the UK.

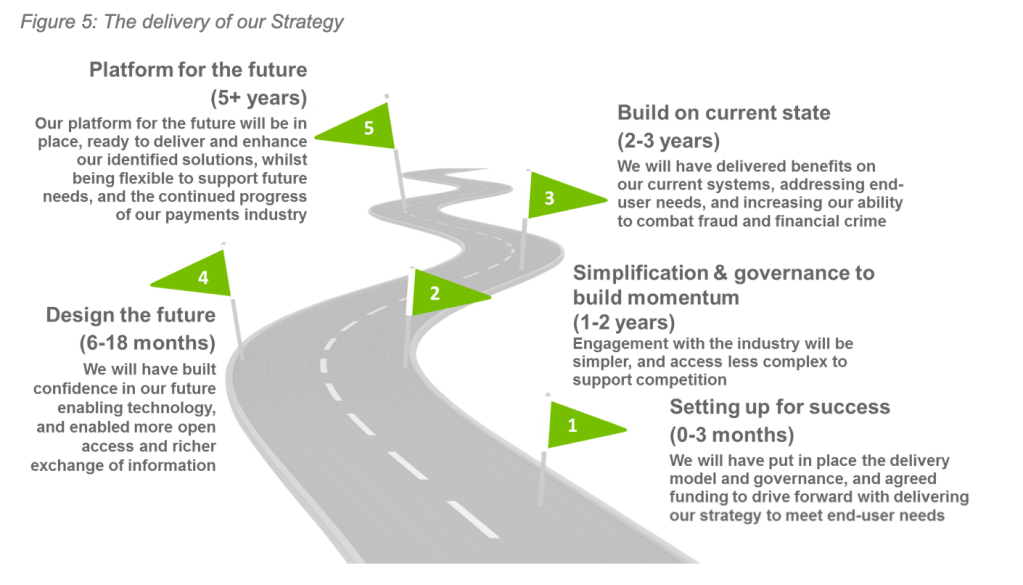

Arguments about the costs and inefficiencies of existing bank payments rails are amusing, if nothing else, and Eichengreen is especially good on the cross-border issues. But when you start to think of the build and roll-out timescales and costs of CBDCs, you rapidly start to see a payments version of the HS2 fiasco. Will the Bank of England build something itself? Hopefully not, if the CHAPS experience is anything to go by (Chaps is the UK’s wholesale payments system for payments over £30,000). When it fell over for a day in, I think, 2016, the backup system was deemed too poor to use. Various enquiries followed, but it is not a happy precedent. Perhaps the Bank will outsource its build? Perhaps to Pay.UK, who are still trying to implement the New Payments Architecture first referred to in 2017.

But build and rollout are only part of the problem – the greater one may well be adoption. If people can’t tell the difference between a CBDC £ and their current account £, why will they alter their behaviour and use CBDCs?. What customer protections will be offered if you use your CBDCs to purchase goods and services? What will the dispute resolution process be?

Hence the Day Kaye picture at the top of the article. The ‘magic suit’ of CBDCs is about as useful as the emperor’s new clothes. Any do watch the Danny Kaye clip on YouTube: https://www.youtube.com/watch?v=VQQ3LCWZJd4